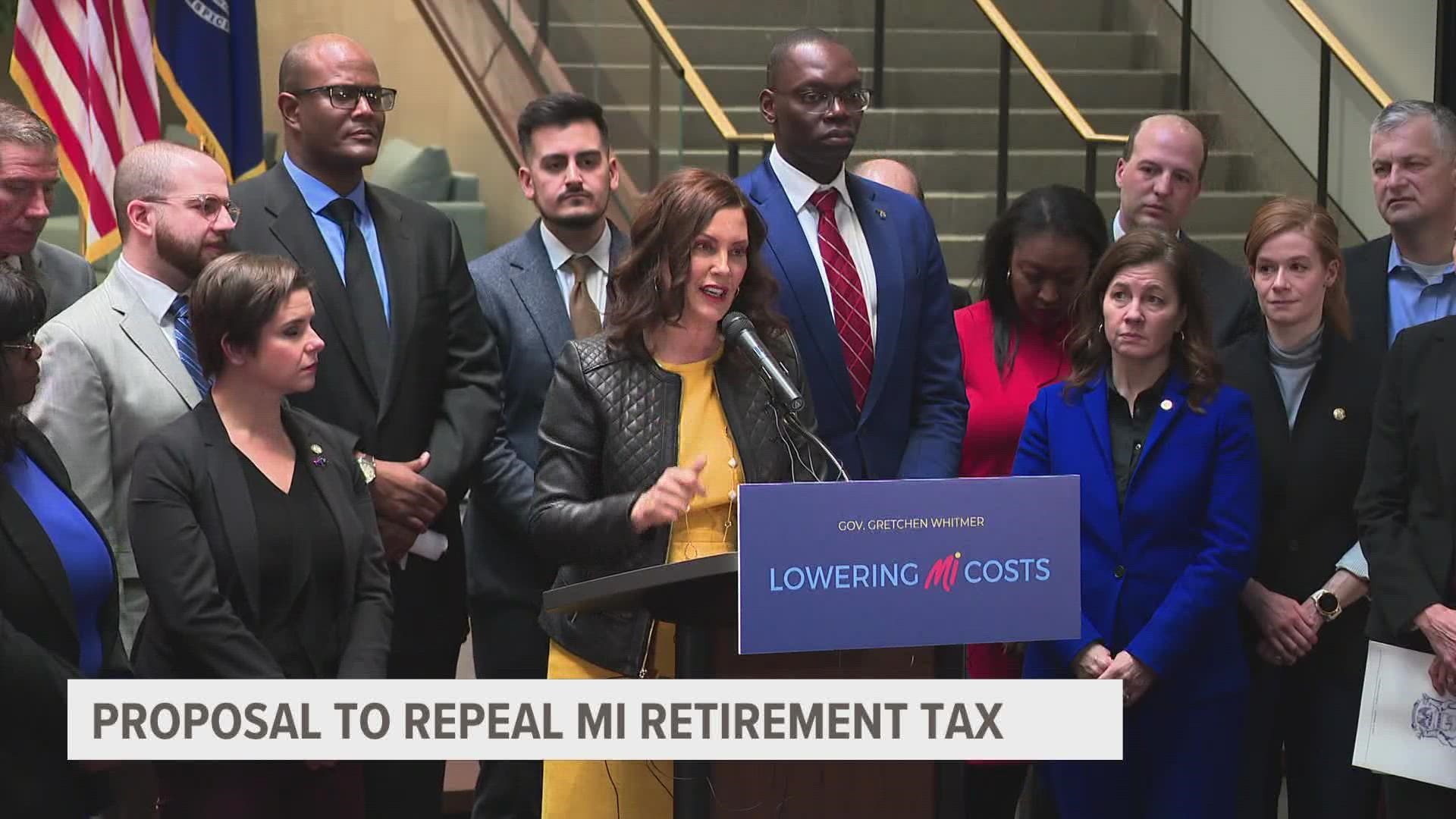

LANSING, Mich. — Following the swearing in of new Democratic majorities in the Michigan Senate and House of Representatives on Jan. 11, Democratic leadership on Thursday announced legislation aimed at repealing the state retirement tax.

The move was announced among a package of six bills revealed by the caucus meant to tackle issues including civil rights protections, labor laws and repealing the state's 1931 abortion ban.

Under current law set in 2011 aimed at helping the state balance its budget amidst the Great Recession, public pensions for retirees are taxed 4.25%.

With circumstances now shifted for the state economy, calls for an end to the tax have grown.

AARP, an influential organization among retirees, released a statement Thursday urging a repeal of the tax.

“Our state did a shameful thing when it pulled the rug out from under a large swath of Michiganders already on fixed incomes who worked hard, played by the rules and paid their dues to retire with dignity,” said AARP Michigan State Director Paula D. Cunningham.

While Democrats have the numbers to pass the legislation if the caucus remains unified, leaders at the announcement Thursday believed bipartisan efforts to be possible.

Senate Majority Leader Winnie Brinks (D-Grand Rapids) said that she’s had positive indications that Republicans are willing to negotiate on certain Democratic priorities like tax relief.

“We’ve had lots of productive conversations,” Brinks said. “I think it’s clear that they are interested in talking about the retirement tax and seeing if there are ways that we can help decrease the tax burden on working families. That’s a very, very good start.”

House GOP leadership have signaled that they are open to amending the state’s tax system to provide potential relief.

Revealing their own package of bills on Wednesday, Republican members of the House made proposals on how to amend the state tax system. While they didn’t go so far as to include a repeal of the state’s retirement tax in their legislation, a bill from Rep. Bill G. Schuette (R-Midland) proposes an increase of the Earned Income Tax Credit (EITC) from 6% to 20%.

In a statement released Wednesday alongside the unveiling of the legislation, House Minority Leader Matt Hall (R-Richland Township) said, “As we begin a new year in the legislature, let’s start by delivering tax relief to workers and seniors.”

With the U.S. Census estimating nearly 100,000 seniors aged 65 and older living in Kent County, an elimination of the tax on public pension could potentially have widely felt impacts across the West Michigan region.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.