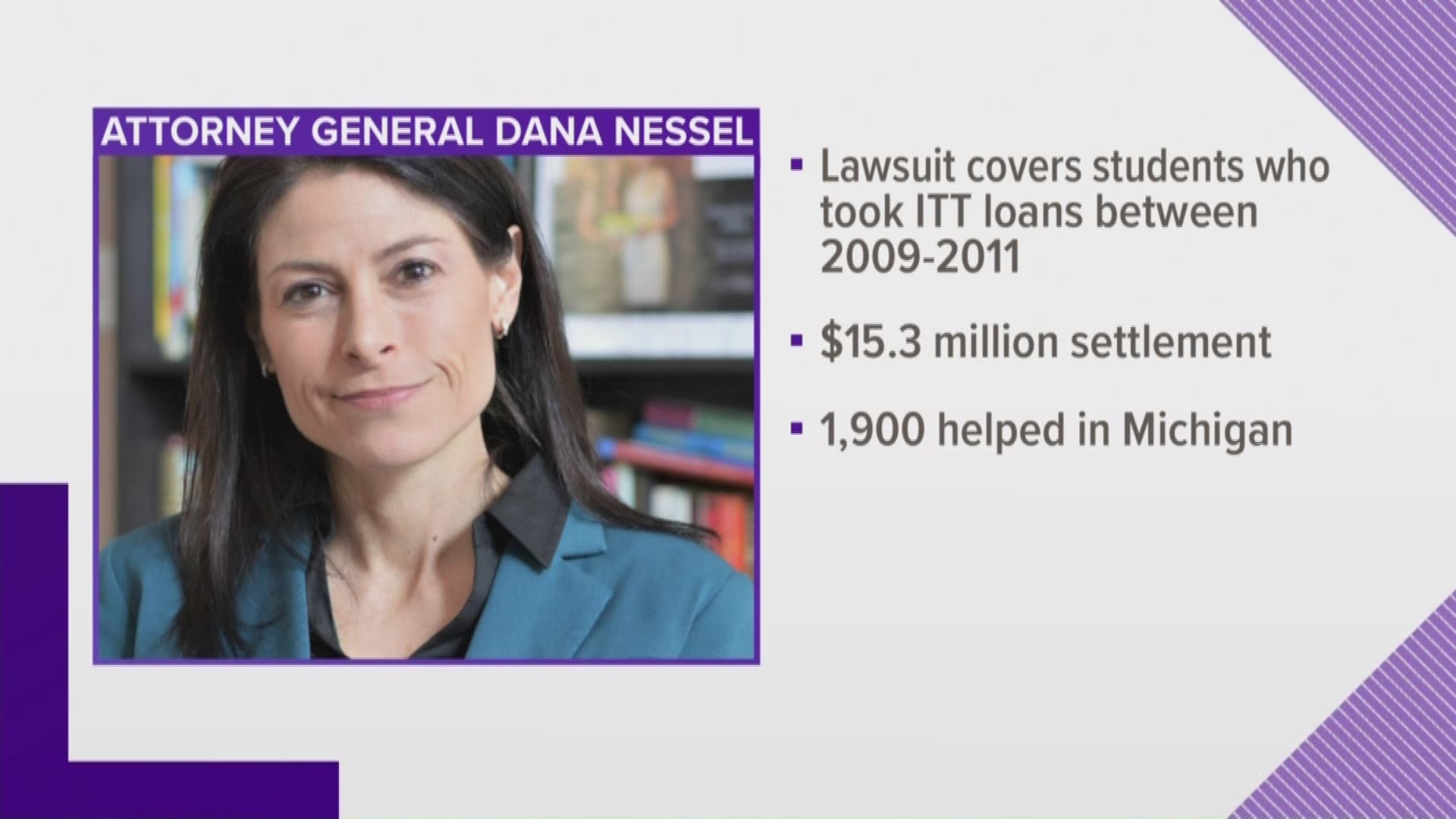

LANSING, Mich. - Attorney General Dana Nessel has reached a $15 million settled for ITT Tech students in Michigan.

The state will receive a total of $15,363,336.52 in debt relief for 1,868 former ITT Technical Institute (ITT) students as part of a multi-state settlement, according to a Wednesday announcement from the AG's office. A group of attorneys general from 43 states and the District of Columbia reached a settlement that will result in debt relief of more than $168 million for over 18,000 former ITT students across the country.

The lending company Student CU Connect CUSO, LLC (CUSO) offered tuition loans at the for-profit institution, originating approximately $189 million in loans between 2009 and 2011. ITT filed bankruptcy in 2016 amid investigations by state attorneys general and following action by the U.S. Department of Education to restrict their access to federal student aid.

The AG office alleged that ITT -- with the lending company's knowledge -- offered students temporary credit upon enrollment to cover the amount remaining after federal aid was applied to the cost of attendance. Students were expected to repay the temporary credit prior to the following academic year -- although many were under the impression that payment, like federal loans, wouldn’t be due until six months after graduation.

ITT Tech pressured students to get loans through CUSO, often at interest rates far above an average federal loan. Officials say ITT would remove students from classes and threaten expulsion if the loans weren't taken.

Because ITT credits are often non-transferable, students would take loans through CUSO and forced to default after finding out how much they would actually need to pay back.

Under the settlement and with no action required from impacted students, the AG's office got CUSO to forego collection of outstanding loans and cease conducting all business, notify all credit reporting agencies of the status for all borrowers, and ensure their loan servicer notifies and cancels all automatic payments. The coalition’s settlement was contingent upon federal court approval of a related settlement between CUSO and the federal Consumer Financial Protection Bureau approved on June 14, 2019.

A copy of the settlement can be found here.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter.