GRAND RAPIDS, Mich. - Financial independence -- a goal everyone should work toward.

Anastasia Wiese is a financial adviser at Grand Wealth Management. She says the best practices for managing your money could be as easy as using an app on your phone.

Here are three apps and websites that you can use to manage your money:

General financial calculations - App: EZ Financial Calculators from Bishinew Inc.

Features:

- Tip calculator

- Credit card payoff

- Compound interest

- Time value of money

- Retirement calculators

- Social security estimator

- Required minimum distribution calculator

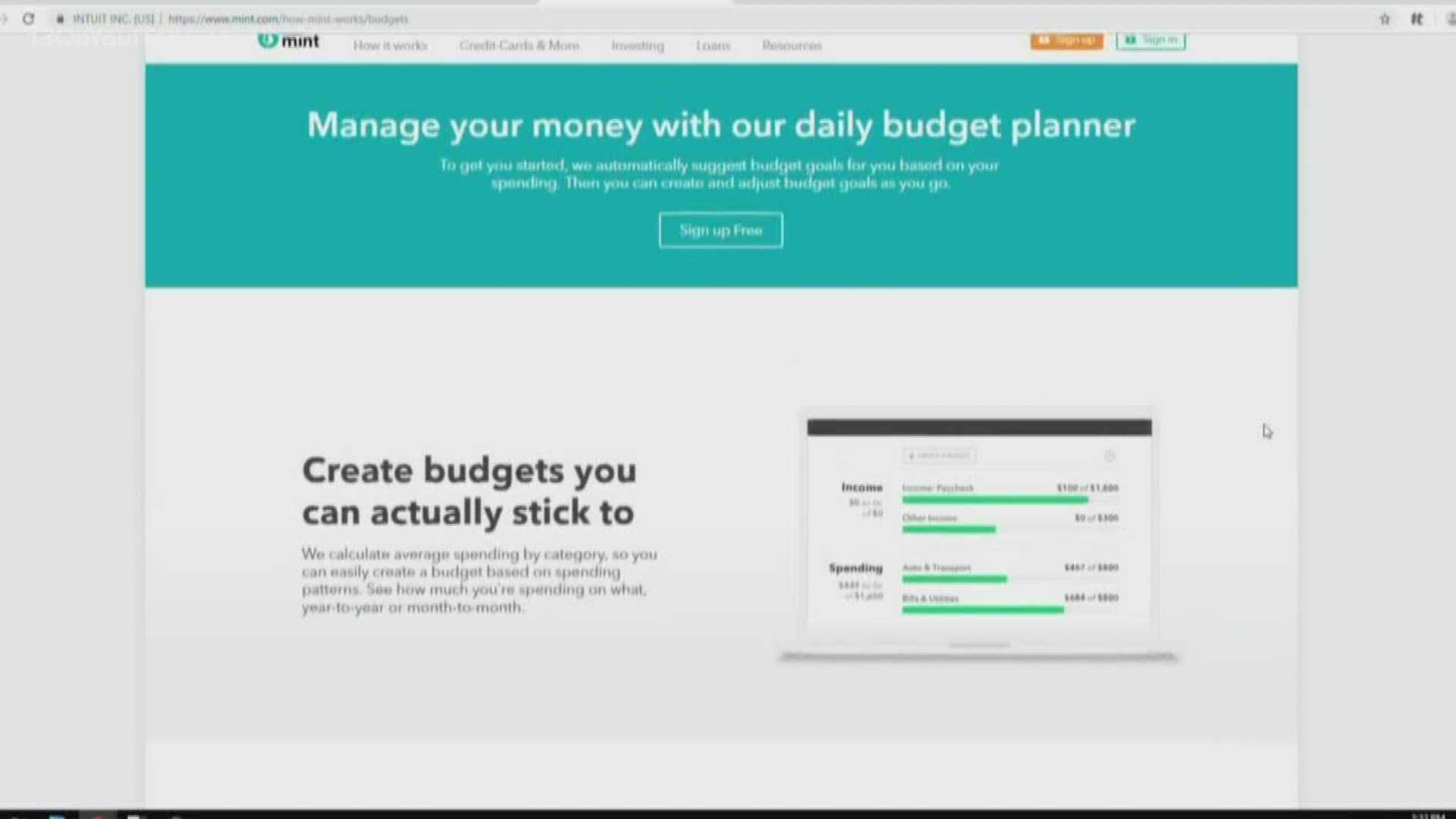

Money management and budgeting- App: Mint (or www.mint.com)

Features:

- Links accounts and apps, directly pulls in your data, updates data regularly

- Views a total current snapshot of your financial landscape; provides a net worth picture

- Create and monitor your budget

- Sets budget goals

- Sets bill reminders

- Tracks credit score

Retirement analysis calculator -- Website: www.vanguard.com/nesteggcalculator

Features:

- Researches retirement variables to determine how long your savings will last

- Additionally, here are more tips from Grand Wealth Management to better manage your personal spending and work toward financial independence.

Top money management tips:

- Learn your inflows and outflows

- Set a goal

- Treat the goal like a non-negotiable (i.e. like a bill)

How to work toward financial independence:

- Identify what this means to you and set the goal

- Understand your current financial landscape

- Pay yourself first; treat your savings like a bill

- Make your money work hard for you

- Be flexible

Top investment tips:

- Today is a great day to start investing

- Come up with a plan you are comfortable with

- Stick with it regardless of what the market does -- stay invested

Stumbling blocks to everything financial:

- Stumbling blocks

- Financial aversion. Money management and investing is intimidating, overwhelming and people fear the word "budget."

- Where to start. Many people don't know where to start or how to get started.

- Steps to overcome roadblocks

- Flip the mindset from this negative place, and instead say, "How am I going to maximize what I have? How can I make my money do more for me?"

- Figure out where you are now. Look at your inflows and outflows. How are you allocating your resources? What do you own and what do you owe?

- Figure out where you want to be. What's the goal?

- Start creating bridges. Am I maximizing my resources? What are some easy changes I can make today? What am I willing to give up today to achieve this goal?

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter.