MUSKEGON HEIGHTS, Mich. — Imagine getting a $27-thousand bill for a vacant property you own.

That’s the reality for Muskegon County property owner Fred Lakes.

He said he was getting nowhere with the city as the due date loomed and contacted the 13 Help Team.

“I was--I was shocked,” Lakes explained. “I just-- I didn't know. I couldn't believe it.”

Lakes was seeing dollar signs over an unwelcome piece of mail he’d recently received: a tax bill with thousands in extra fees.

He’s lived in a home on 6th Street much of his life, yet the present issue stemmed from the two-story next door.

Circa 20 years earlier, the west side property had carved out a troubling reputation as a known drug house and chronic neighborhood problem spot.

The house was condemned, Lakes said, when he made the decision to buy it in 2002.

“We try to do our best, taking care of the property and keeping it up so that it's not an eyesore,” Lakes noted. “Improve the neighborhood.”

Putting in his own sweat equity since the sale, Lakes said not everyone had recognized his efforts.

In 2020, he received a notice on Muskegon Heights letterhead, assessing the property with a $500 ‘vacant building fee.’

Lakes said he wasn’t aware of the penalty prior to receiving the notice and fought the charge.

“Eventually that got dropped,” he said. “I thought that was it, go back to working on the house, and so on and so forth. But come the following year, things started happening again.”

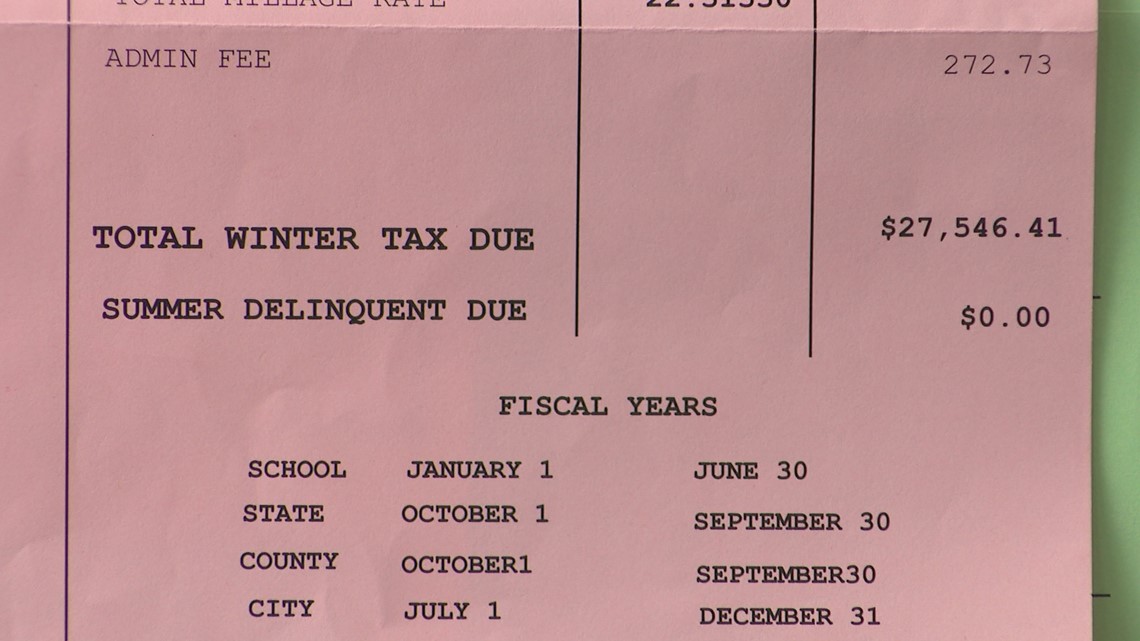

The frustration came back with a vengeance when his city tax forms arrived in the mail last summer. Previous forms show Lakes usually owed between $270 and $600, yet the bill he received featured thousands of dollars in extra charges.

“We ended up with a Past Due billing of $3,500 and so I had to go through this again,” he related.

Lakes later got the charge reversed like the last one…

Or so he thought until the next bill arrived. $27,546.41.

“What's your first reaction when you get that in your hands and you tear open the letter and it's $27,000?”

“Well, you look at it for a long time to make sure that my eyes aren't deceiving me,” he laughed. “I want it to protest because I figured from what I was reading in the ordinance, it did not qualify as vacant.”

The ordinance he referenced details the criteria used to classify a home as vacant--when no one actively lives or conducts business inside.

The rules also require evidence including proof of continual utility use and annual registration.

Lakes didn’t believe that definition should have been applied to his situation.

The lights, he said, had remained on through the renovation and ongoing plumbing repairs meant water service had also recently been restored.

Lakes added the property was better off by a long shot than when he took over.

“It makes me a little skeptical,” he said. “I don't want to think that I'm being picked on.”

Cross-referencing his bill with the fee schedule attached to the bottom of the ordinance, the numbers didn’t appear to support what the city claimed was due.

The notice he received also claimed an inspector had examined the property to make the determination the home was vacant and that the ordinance applied before the bill was printed. Lakes said he had never been contacted.

Given the Feb. 15 due date printed at the top of his tax bill, Lakes said he was urgently attempting to sort the situation out with city hall, to no avail at the time of publication.

“Can you pay the city $27,000 for this property?”

“No, no, no, I'm retired. I can't. I have a fixed income,” Lakes related. “It would take me years, years to even accumulate that much money now, let alone pay it out as a bill… I just hope the outcome is positive.”

The 13 HELP TEAM attempted to contact the City of Muskegon Heights via several different channels but had yet to receive clarification at the last check.

Monday’s City Commission agenda featured a tax-related discussion that was ultimately tabled with the intention of consulting the city attorney’s office.

The discussion was moved to Monday, Feb. 13.

Any additional information will be appended to this story.

If you or someone you know is having problems you can’t solve – get the 13 Help Team involved.

Send an email to help@13onyourside.com.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.