LOWELL, Mich. — The City of Lowell is looking to the community to help fund necessary road repairs.

On Tuesday, Nov. 5, residents will be asked to consider a ballot proposal allowing the city to collect an income tax in order to make those repairs.

According to the City of Lowell, other options have been reviewed including the elimination, closure or sale of some current programs and assets such as eliminating the police department, closing the Kent District Library branch and selling Lowell Light & Power, before approving the income tax ballot proposal.

The income tax would be 1% of adjusted gross income from residents and businesses and 0.5% of adjusted gross income from non-residents. The tax income would be collected for 15 years, beginning January 1, 2020.

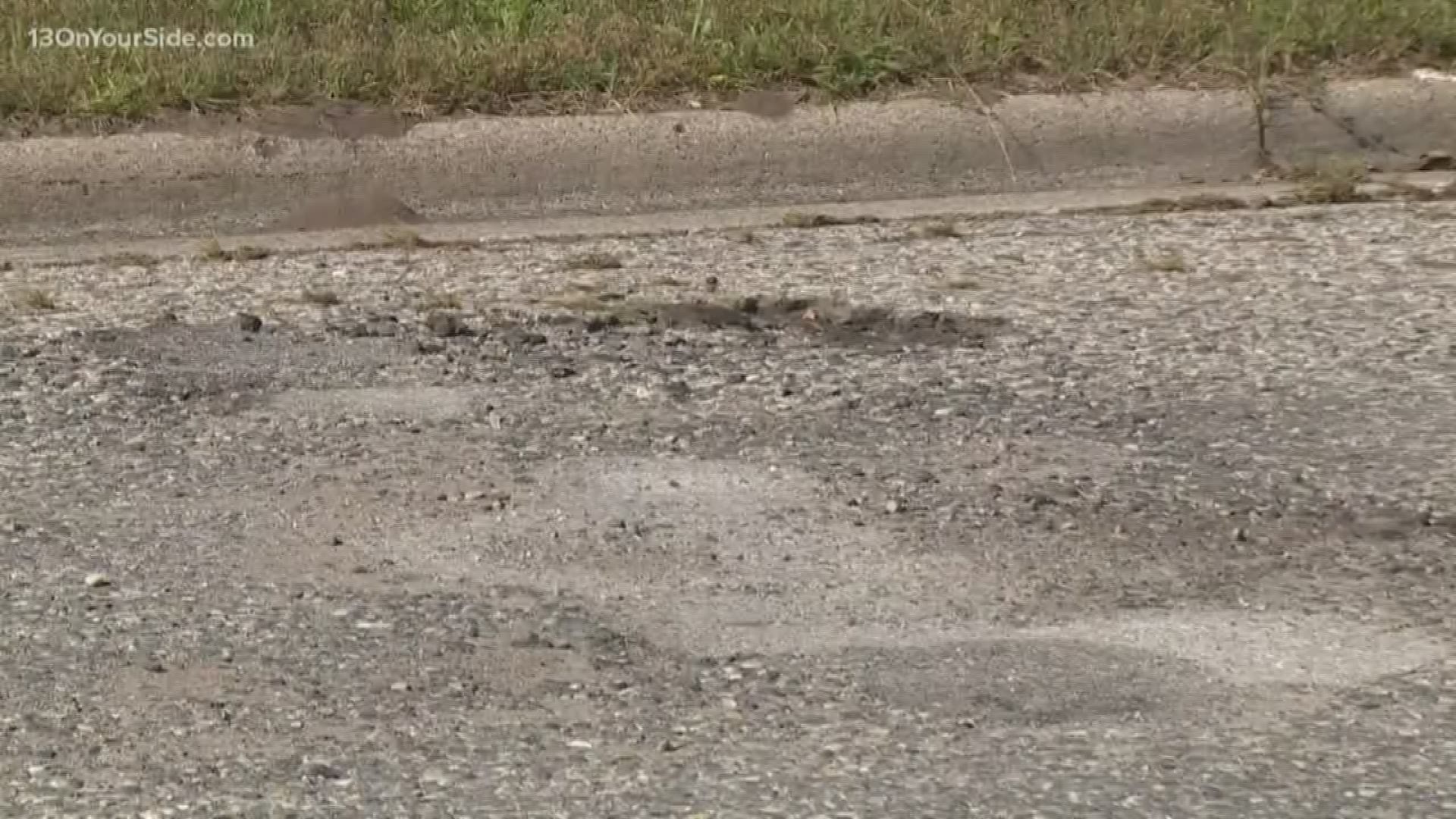

“It’s no secret: street conditions in the City are at an all-time low,” said City Manager Mike Burns. “Yet current revenue does not support the significant investment needed to reverse this trend and improve our streets.

“We get regular calls and complaints from residents, business owners and visitors about how tough it is to drive through our community. The city researched a number of funding sources, but ultimately choose an income tax rather than a dedicated street millage. In most instances, we believe this will be a less costly way to raise the additional funds needed to fix Lowell roads.”

"91 percent of our roads are fair or poor, of that 91 percent, 67 percent are poor," says Burns.

Retirement income for seniors, along with military pay, unemployment benefits, welfare relief, tax refunds and other types of income, would be exempt from the tax. According to the city, property owners exempt from paying income tax will see a significant reduction in their tax burden as the city plans to reduce property taxes.

Of the approximately $1.2 million raised via an income tax, the city projects approximately $770,700 will be used for streets in the first year.

“If the income tax is not passed, roads and critical infrastructure within Lowell will continue to deteriorate,” Burns said. “This request is in line with other municipalities around the state. There are 24 cities in Michigan that collect an income tax. Lowell’s proposed rates are comparable to cities of similar size in our state.”

At the end of 2034, the income tax may be extended if approved by voters.

The City of Lowell will be holding three informational meetings at Lowell City Hall regarding the ballot proposals:

- Sept. 18, 6 p.m.

- Oct. 1, 10 a.m.

- Oct. 16, 6 p.m.

For more information on the ballot proposal, including a calculator that would allow residents to evaluate their personal tax impact, visit www.lowellmi.gov.

RELATED VIDEO:

Other headlines on 13 ON YOUR SIDE:

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.