MUSKEGON COUNTY, Mich. — By the end of the 2018-2019 school year all 2,112 kindergarten students in Muskegon County will have a college saving's account to claim as their very own.

The accounts are one way to get the county's youngest students thinking about post-secondary education.

The Community Foundation for Muskegon County will open accounts in each student's name, and make an initial deposit of $50.00. That deposits and others into the account will grow and eventually help the student pay for college or a trade school.

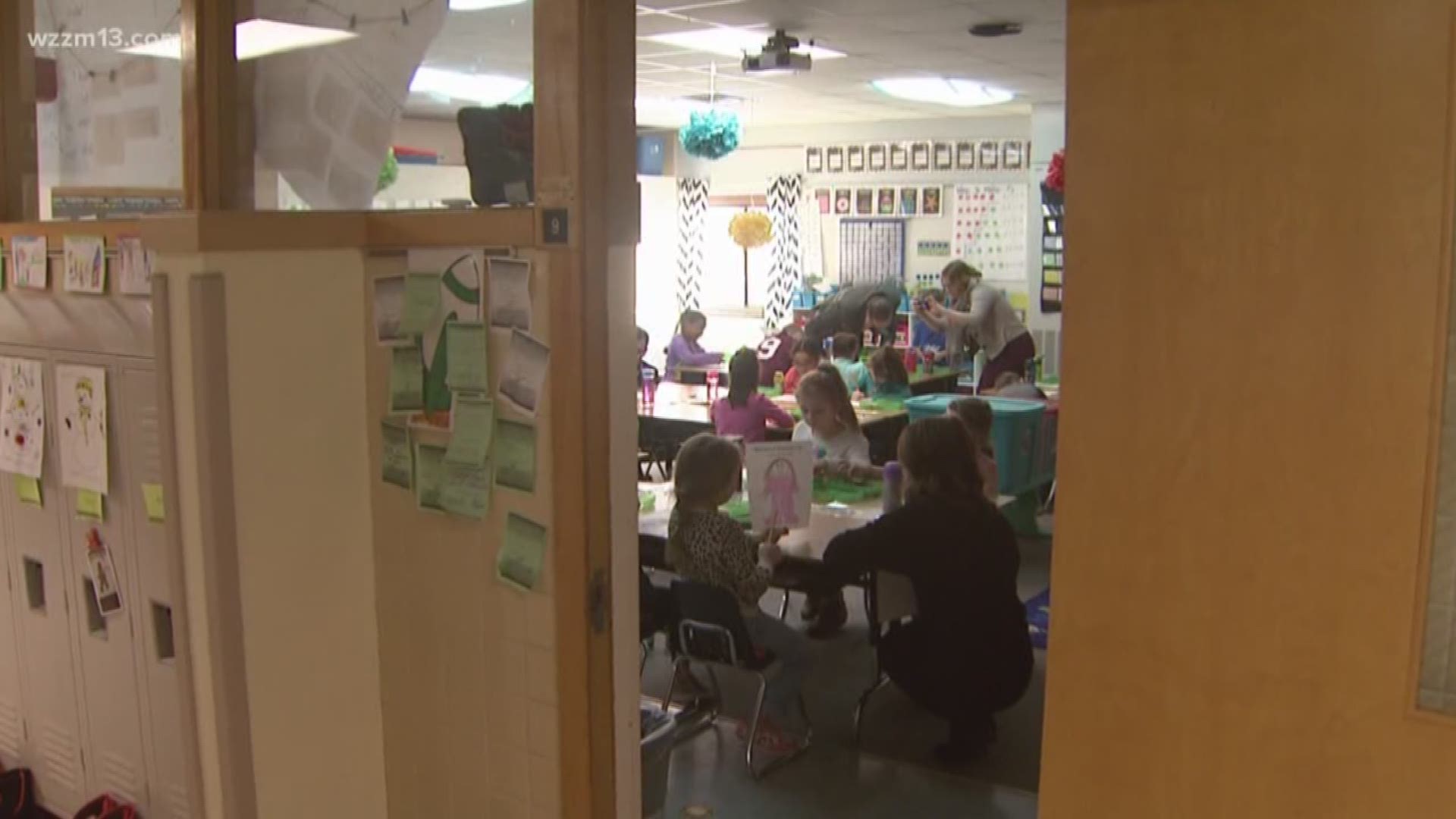

Twin Lake Elementary students in the Reeths-Puffer School District were the first to receive their accounts, a KickStart piggybank, and a quarter to put into their new bank.

The announcement at their school Friday, Feb. 22, included representatives from the foundation, the Muskegon Area Intermediate School District, and seven Muskegon-area banking institutions participating in the KickStart to Career program.

In 2019 alone the Community Foundation for Muskegon County will make just over $100,000 in deposits into KickStart to Career college saving accounts.

All kindergarten classrooms in Muskegon County will be visited by the end of the school year by the team making the announcement to students.

"We've got the commitment that we will be able to do this perpetually," said community foundation President Todd Jacobs.

As the students progress towards high school graduation there will be ways for them to earn deposits into their account.

"A $5.00 incentive for different classroom activities," said Kari Wiersema, KickStart to Career Coordinator for the Muskegon Area Intermediate School District. "And then as they get older we will look at designing that around career development, attending a career fair, or doing a job shadow."

The banking institutions involved in the program encourage parents and relatives of the students to make additional deposits to help the accounts grow. "For their birthday, for anything special, for getting good grades," said Maria Pena, Marketing Specialist Family Financial Credit Union.

Education and community leaders believe the investment is the early boost students need to eventually land great careers.