GRAND RAPIDS, Mich. — UPDATE 4/15/22, 1:50 p.m.: Lake Michigan Credit Union (LMCU) has issued a statement in regards to this story:

LMCU refutes some of the information presented in this story that is not factually accurate. Unfortunately, LMCU is unable to comment further on any individual’s account in compliance with Federal and State Laws and the Michigan Department of Insurance and Financial Services (DFIS), which prohibit LMCU from sharing member account information. DFIS and LMCU’s attorneys evaluated this situation and found LMCU has followed the approved procedures and processes and has done everything right in resolving this matter.

ORIGINAL STORY: Malinda Myers recently retired, and for the past year she’s been depositing money into an account with Lake Michigan Credit Union. Myers, who lives near Naples, FL, said she chose LMCU because there are branches near her home, and she had heard good things. While checking her account last November, she said she discovered fraudulent activity had occurred months earlier in June and July.

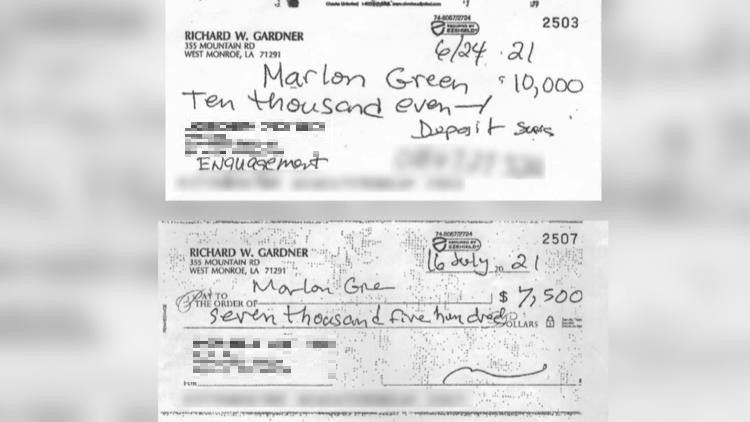

“There were these two checks that had been written,” Myers said. “The checks don't bear my name. They have a man's name on them. They have only my Lake Michigan Credit Union routing number and my account number.”

The first check, dated June 24, 2021, was for $10,000. The check includes the name Richard W. Gardner, complete with an address, and it’s made out to Marlon Green. The second check, dated July 16, 2021, was for $7,500 and includes the same names. According to Myers, both checks were cashed at a Regions Bank, and the funds were pulled from her account without any alert from the LMCU fraud department.

“When I asked how a check can go through an account that never even had checks, the fraud department said they don't have the ability or manpower to know each check that goes through,” she said. “Some sort of security system should have picked up on this and alerted me or called me.”

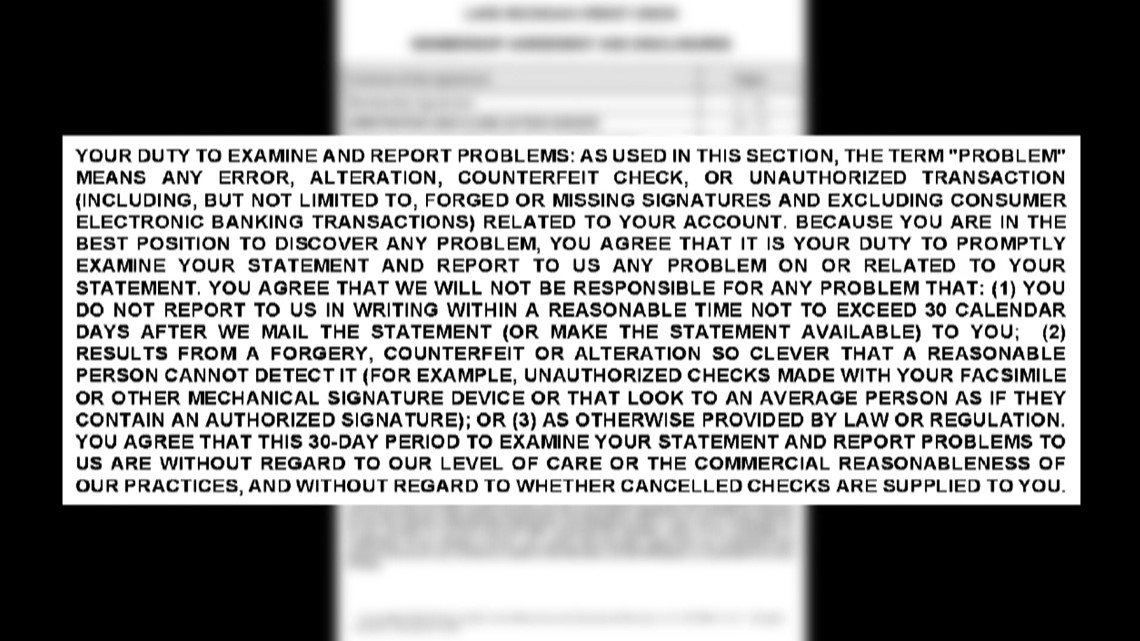

To make matters worse, because so much time had already passed, there wasn’t much LMCU could do. In the membership agreement that Myers signed, it states the member has 30 days from the date of the disputed transaction to notify LMCU of fraudulent activity.

“They said they are not liable, because I reported it after 30 days," she said. "I was just too late."

To Myers, it’s a lesson that was learned the hard way.

“Peace of mind is what you think when you deposit your money into a bank or credit union, but you really have to watch it yourself, because you could wake up and your money could be gone, and that's it,” she said.

We spoke to a representative from the LMCU fraud dept. He could not speak about this specific case, but he did tell us that the timeline to report fraud depends on the situation. He said they do their best to help every LMCU member, but there are limitations to what they can do.

Bottom line - keep a close eye on your bank accounts, and if you see any suspicious activity, report it immediately.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.