One of the most popular financial provisions approved by Congress in response to the COVID-19 pandemic was the advance monthly child tax credit. It was received by tens of millions of Americans and was estimated to help lift millions of low-income children out of poverty. And while the final monthly payment of 2021 went out Dec. 15, there is still more of that money coming to Americans in 2022.

The child tax credit will continue, in some form. Whether that includes monthly payments and how many parents will be eligible will be up to Congress. That effort took a significant turn on Sunday.

Here's a look at what taxpayers who took the monthly checks need to prepare for, what people who didn't take it can expect and what the future holds for the child tax credit.

What is the history of the child tax credit?

The child tax credit already existed before 2021. It started as a $500 per child write-off under Bill Clinton in 1997 and it changed over time.

Up until 2017, parents making up to $75,000 individually or $110,000 if they were married and filing jointly received $1,000 per child under age 17. It was paid all at once when tax returns were filed.

The 2017 Tax Cuts and Jobs Act increased that amount to $2,000 and increased the income threshold to $200,000 for individual tax filers and $400,000 for couples filing jointly, again with the money being paid after taxes were filed. It also made $1,400 of the credit refundable. Again, it was one payment when taxes were filed.

Under the American Rescue Plan passed by Congress in March 2021, the child tax credit was increased to $3,600 for children age 5 and under and $3,000 for those ages 6-17 and it was to be made available in monthly installments. The money was also made fully refundable.

Income limits were $75,000 for individual parents, $112,500 for a head of household and $150,000 for parents who filed their taxes jointly. The amount was reduced after that, with individuals making up to $200,000 and couples making up to $400,000 receiving the $2,000 the credit was before the American Rescue Plan was passed.

What are advance child tax credit payments?

Starting in July, eligible parents who had 2019 or 2020 tax returns filed with the IRS were automatically enrolled to start receiving monthly payments. Those payments were an advance on the 2021 tax credit.

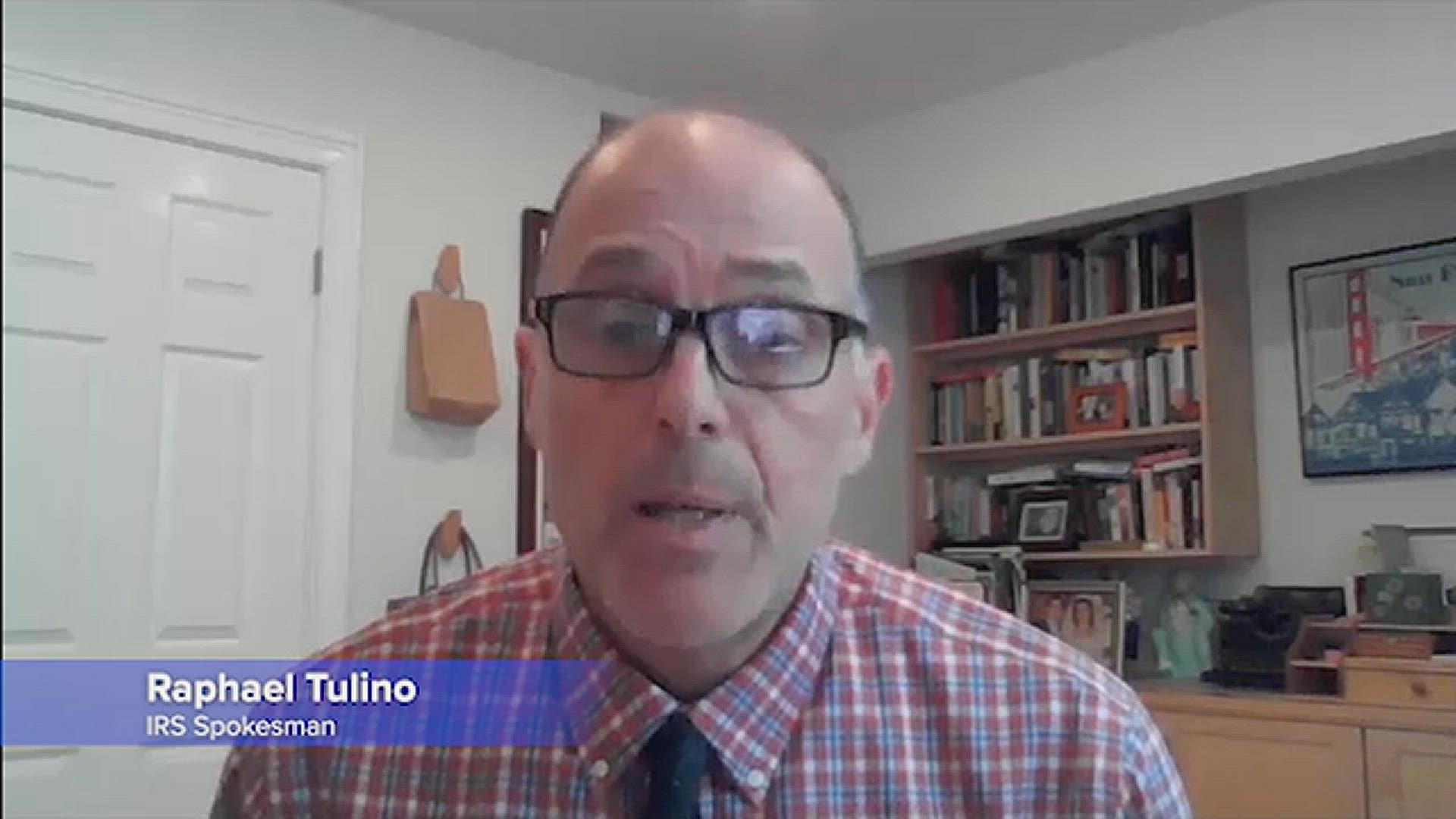

"The advance child tax credit is basically giving you half of the credit in advance of putting it on a tax return which is normally done," explained IRS spokesman Raphael Tulino. "But the law has us administering that immediately and sending those payments out this year in the six months that we did."

The amount of the payments were based on a 12-month calendar, but they didn't start until July. So parents could only receive half their total child tax credit money ($1,800 or $1,500) via those payments -- $300 per child per month under age 6 and $250 per child per month for ages 6-17.

Parents whose incomes were so low that they were not required to file a 2020 tax return were not automatically enrolled into the monthly payments. But the IRS made an online tool available for them to sign up. And those who signed up right before the Nov. 15 deadline were eligible to receive all the monthly payments from 2021 in one lump sum on Dec. 15.

Is another big child tax credit payment coming in 2022?

Whether or not they took the monthly advance payments, eligible parents can expect one more big payment in 2022. That's because only half the money came via the monthly installments.

Parents who did not opt out of the monthly payments will get $1,500 or $1,800 per child, depending on the child's age, after they file their taxes in the spring of 2022. Those who opted out of all the monthly payments can expect a $3,000 or $3,600. If parents opted out of some payments, but not all, they can expect something between $1,500 - $3,000 for the younger children and $1,800 - $3,600 for the older kids, depending on when they opted out.

That final payment will also go to eligible people who don't normally file a tax return.

Will the IRS tell me how much child tax credit I received in 2021?

Yes. The IRS will be sending out a letter to tell parents how much child tax credit money they received in 2021.

"That tax return that you file for 2021 at the beginning of next year plus the letter you get -- (Letter) 6419 from the IRS -- that outlines what you got, you and/or your family, will help you reconcile and put the correct number on the tax return for the full amount of what you're owed when you file that tax return," said Tulino.

The letter will go to the most recent address the IRS has on file. Taxpayers can update that address through the child tax credit update portal.

What happens if I received too much monthly child tax credit money?

The advance child tax credit payments were based on 2019 or 2020 tax returns on file. Those returns would have information like income, filing status and how many children are living with the parents.

But those parents may have had life changes in 2021 which would impact how much money they were eligible for. These could include:

- Income increased to the point the parent was no longer eligible.

- A qualifying child may not have lived with the parent for at least half the year.

- Tax filing status may have changed.

- The parent's main home may have been outside of the U.S. for more than half the year.

Those people may have to repay some or all of the money they received in the monthly payments. But not everyone will have to.

"There's something called repayment protection and that could mean that some taxpayers on the lower to moderate income tax brackets may not have to pay it back," said Tulino.

Specific details about who qualifies for repayment protection under the scenarios listed above can be found at this link on IRS.gov.

Will the monthly child tax credit payments continue in 2022?

There was a significant development Sunday that made an extension less likely, at least not in time for a January payment.

A one-year extension was passed by the House of Representatives in November as part of President Joe Biden's $2 trillion Build Back Better domestic and environmental economic package. In the Senate, there is a 50-50 split between both parties with Democrats holding the tiebreaker in Vice President Kamala Harris. Knowing no Republicans planned to vote for the bill, Democrats need every one of their members to vote in favor.

But Sen. Joe Manchin, D-W.V., told "Fox News Sunday" that, "I cannot vote to continue with this piece of legislation. I just can’t. I’ve tried everything humanly possible. I can’t get there."

Manchin's choice of words seemed to crack the door open to continued talks with Biden and top congressional Democrats over reshaping the legislation. But the West Virginia senator all but said the bill would die unless it met his demands for a smaller, less sweeping package — something that would be hard for many Democrats in the narrowly divided Congress to accept.

Manchin denied a report last week that he wanted the improved child tax credit eliminated from the bill.

As of Monday morning, it was not clear what the White House might do to revive the bill or the extension of the child tax credit.

If the negotiations drag into 2022 and the bill still passes, the monthly payments could be revived retroactively. Senate Finance Committee Chairman Ron Wyden, D-Ore. has said the IRS has a Dec. 28 deadline to pass the bill so checks can go out on Jan. 15. Wyden also said last week that all options are on the table for discussion to continue the payments, including a possible standalone bill.

White House Press Secretary Jen Psaki said last week that if an extension isn't passed until January, parents might get a double payment in February.

Does the child tax credit end if Congress doesn't pass an extension?

No, but it won't be as much and it won't be monthly.

"If nothing is done, as I understand it, you would revert back to what it used to be from the Tax Cuts and Jobs Act which is a tax credit that goes on a return that you file once a year and you take that tax credit that way," said Tulino.

That means the child tax credit returns to a $2,000 lump sum for individuals making up to $200,000 and couples filing jointly who make up to $400,000, with $1,400 refundable. That money will come at one time when 2022 taxes are filed in the spring of 2023.

That $2,000 child tax credit is also due to expire after 2025.

Loss of child tax credit could send millions into poverty

One of the stated goals of the monthly child tax credit and its increased amounts was to cut childhood poverty. The idea was to give parents money as they needed it rather than in one big chunk. It also gave the money to millions of families with low or no income, even if they didn't earn enough money to pay income taxes or pay enough tax to qualify for the refund.

The nonpartisan Center on Budget and Policy Priorities (CBPP) said in December that 88% of low-income households receiving the monthly payments were using it on food, clothing, rent, mortgage and utilities. It was 91% if education costs are included.

Part of the reason, again, was that the enhanced child tax credit was fully refundable -- meaning more low-income and zero-income families qualified for the total amount.

"Previously, 27 million children — including roughly half of Black and Latino children and half of children in rural communities — received less than the full credit amount, which higher-income children received, because their parents’ income were too low," CBPP said.

Families in New Mexico, which has one of the country's highest child poverty rates, spent nearly 46% of their child tax credit money on food, a study by Washington University in St. Louis’ Social Policy Institute found.

“It says a lot about what families are worried about,” said Sharon Kaye, communications director for New Mexico Voices for Children. “This is hugely important to a lot of families.”

If the increased payments go away, CBPP estimates nearly 10 million in the U.S. would be thrown back into poverty or slip deeper into poverty.

In one example to explain this, CBPP said a single mother making $12,500 part-time while raising a toddler and a second-grader would receive $5,100 less for all of 2022 -- including the loss of the monthly payments which, for her, would amount to $550 per month.

Emma Mehrabi, director of poverty policy at the Children’s Defense Fund, called the potential interruption of payments “a real slap in the face for families in need.”

She said, "There is no other tool in our toolkit that has significantly reduced child poverty for decades.”

The Associated Press contributed to this report.