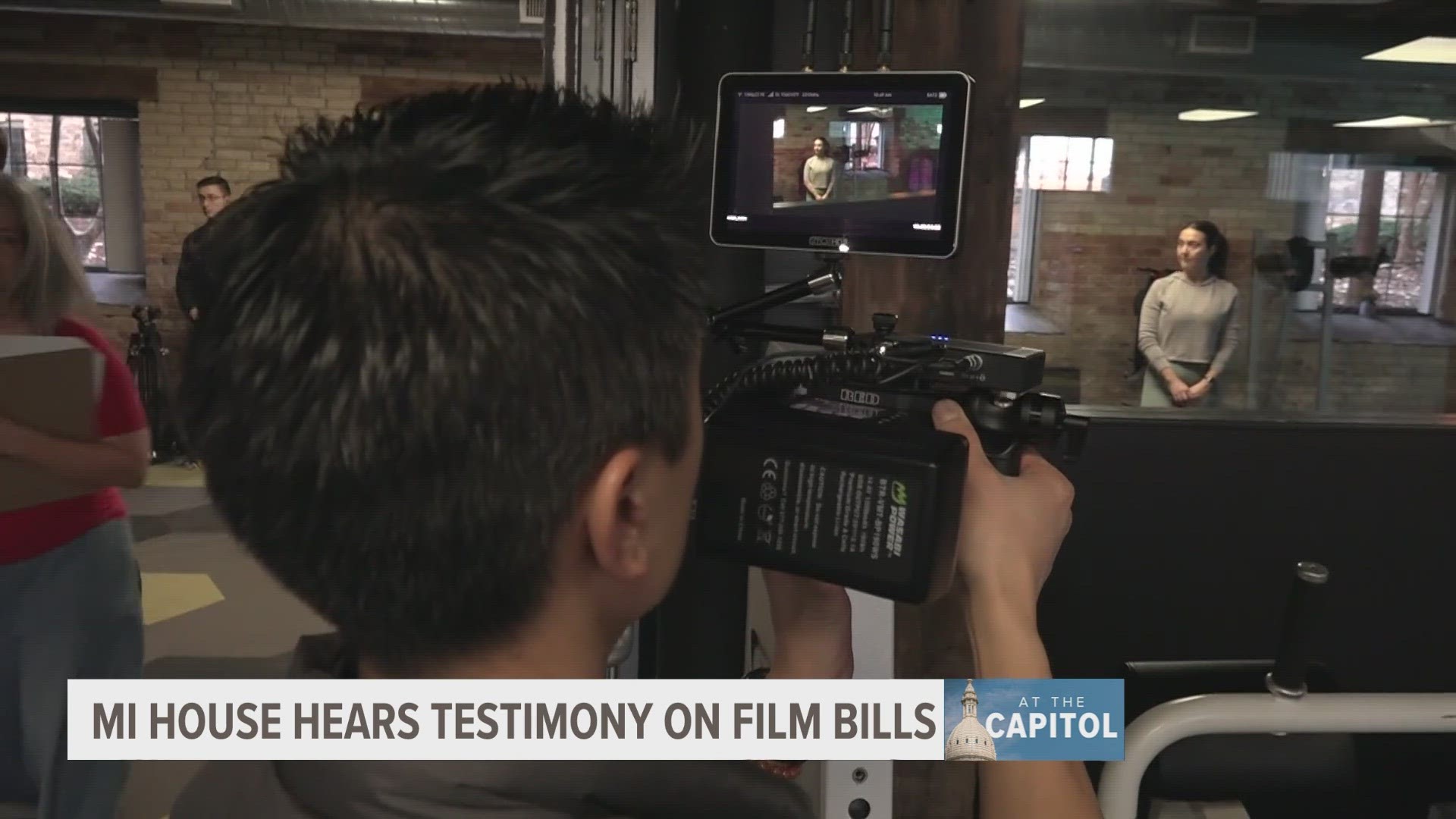

LANSING, Mich. — After months of waiting for many in Michigan's film industry, there were signs of movement in Lansing on a pair of bills many local filmmakers say would help bring the major films and commercials of tomorrow to Michigan.

A state House committee heard testimony Tuesday on the legislation that would, if passed, install film tax credits in the state, designed to encourage film producers to come here.

"The Multimedia Jobs Act really incentivizes producers from all over the country to spend money in Michigan," Michigan Film Industry Association Board Member Bill Latka told 13 ON YOUR SIDE. "This is money that would have been spent elsewhere, and we're saying, 'Let's set up our state to welcome these producers, bring them here and put all of our people to work.'"

Among those who testified were both current and aspiring filmmakers from around the state - including from West Michigan.

One such supporter of the bill was Hannah Scout Dunaway, a senior studying film and video production at Grand Valley State University.

"I desperately wish to stay in my home state and build my life here, but that dream is not presently feasible with the current state of the film industry in Michigan," Scout Dunaway told lawmakers. "The film industry is highly competitive, and with the passing of House Bills 4907 and 4908, I and many other young creatives would have the opportunity to not only forge our paths as filmmakers, but to also start our own families and keep up with the growing industry at large."

While Michigan did have incentives in the past, those were removed in 2015.

The new credits would be somewhat different, with what proponents say are safeguards to make sure the benefits stay here in Michigan.

"The last time Michigan wrote checks that went out of state," Latka said. "This time, that is not going to happen. When producers come here and they do their initial spend, they tally up the receipts and it all goes to a Michigan [certified public accountant] for verification that the money was actually spent here. And when it's done, the production company or the entity that owns the production that got filmed gets a tax credit that's good for a Michigan tax liability."

If unused, Latka explained such a credit could also be sold to other local businesses to count toward their taxes.

"So, if they don't have a Michigan tax liability, they can sell it to another company that does," Latka said. "And this means that any business in Michigan can benefit from this. It could be a brewery, it could be a hotel chain, it could be one of the big three automakers. Anybody that has a Michigan tax liability can purchase that incentive and then apply it to their tax liability. So, we're not really sending money out of the state."

But some in the room on Tuesday were not convinced the credits would be worth the expense.

"The $500 million that we spent on film production [during the previous incentives] could have been spent on schools or roads or poverty alleviation programs that also have the secondary and tertiary benefits that our film industry have pointed at as the primary benefits of this program," James Hohman, Director of Fiscal Policy at the Mackinac Center for Public Policy James Hohman said.

"I don't know if we're getting the data that we need to make the decision as an economic development piece of legislation," State Rep. Greg VanWoerkom (R-Norton Shores) said during questioning.

While the package already has bipartisan support - with one bill sponsored by State Rep. Jason Hoskins (D-Southfield), and the other by State Rep. John Roth (R-Interlochen) - it will have a long road ahead if it is to make it into law.

Another date will have to be scheduled for the committee to vote whether to send the bills to the full House for a vote. It would then have to go through the same process over in the Senate, and both chambers would need to agree on a final version if it hopes to make it to Governor Whitmer's desk for a signature.

►Make it easy to keep up to date with more stories like this. Download the 13 ON YOUR SIDE app now.

Have a news tip? Email news@13onyourside.com, visit our Facebook page or Twitter. Subscribe to our YouTube channel.

Watch 13 ON YOUR SIDE for free on Roku, Amazon Fire TV Stick, Apple TV and on your phone.